Frequently Asked Questions

How do I link my checking and savings account to my Altruist account(s)?

How do I set up deposit into Altruist?

How do I link my checking and savings account to my Altruist account(s)?

Add Electronically via Plaid on Desktop Portal

You’ll click the top right icon that contains your initials.

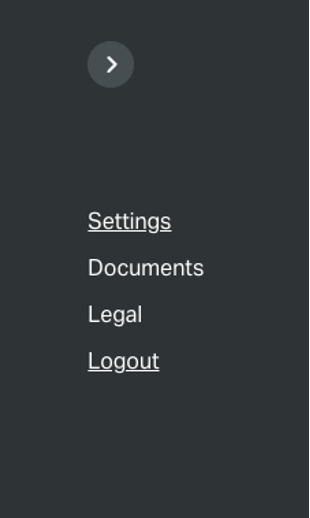

Click "Settings" in the bump out menu.

Then once in settings, click the "Accounts" subtab.

Scroll down to "Funding Accounts" section and click "Add".

Next, a bump out menu will appear with options. Click "Link your bank".

On the mobile app

Tap Profile > Funding Accounts > Choose which account you are linking > Add Funding Account > Add New Bank > Link your bank

Once you click to link your bank, a window for "Plaid" will open. Plaid works between financial institutions to provide a secure connection to link your accounts.

In the plaid window, click continue. Then choose your financial institution you are linking if it is in view, or search in the search bar.

Once you click your financial institution, provide your credentials to log in, and follow the prompts.

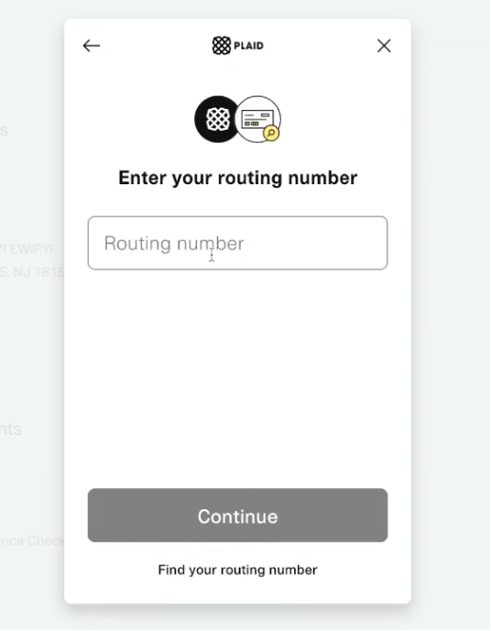

If you are unable to find your institution, no problem. Just scroll down below the list of banks for the option at the bottom that says “Link with Account Numbers.”

Next input your bank account and routing numbers directly.

In 1-3 business days, you will receive a micro-deposit with a transaction number.

Once the account(s) are linked, you can also set up one-time or recurring automatic deposits at the frequency you prefer.

Add Manually on Desktop

If you are having trouble connecting to the Plaid platform, or prefer to connect your account manually, see the instructions below: click the top right icon that contains your initials.

Click "Settings" in the bump out menu.

Then once in settings, click the "Accounts" subtab.

Scroll down to "Funding Accounts" section and click "Add".

Add Manually on the Mobile App

Tap Profile > Funding Accounts > Choose which account you are linking > Add Funding Account > Add New Bank)

Next, a bump out menu will appear with options. Click "Add manually".

Input your information requested and upload a picture of a voided check or statement that includes your full account number. Then hit next.

How do I set up deposit into Altruist?

Getting started

To set up regular or one-time contributions to your retirement accounts or deposits into any account, you first need to link your outside account you would like to transfer in from to the account you are looking to contribute to.

On the Desktop Portal

Go to settings > click the "Accounts" tab > Scroll down to "Funding Accounts" section and click "Add Funding Account"

On the Mobile App

Tap Profile > Funding Accounts > Choose which account you are linking > Add Funding Account > Add New

Make a One-Time Deposit

To make a one-time deposit, log into Altruist.

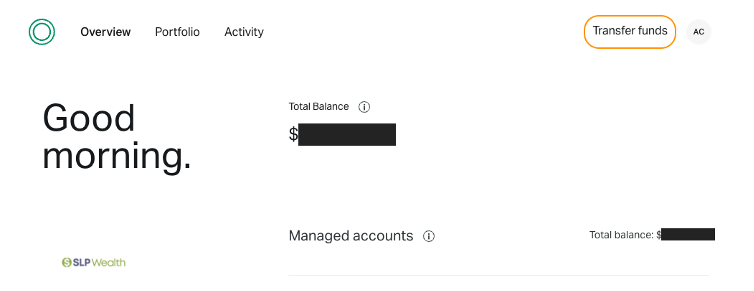

Click "Transfer Funds" in the top right of the screen.

From the bump out menu, click "Deposit into Altruist".

In the "Transfer to" field, choose the account you would like to make a deposit or retirement contribution in.

In the "Transfer from" field, choose the outside account you would like to transfer in from. If the account you are looking for is not in the options, click "Add funding account".

NOTE: if you would like to transfer from an Altruist HYSA account, you will need to reach out to your planner to set up the transfer for you.

For "Frequency" choose "Once" and then choose the date and amount you would like to transfer.

*If you are making a deposit into a retirement account (IRA, Roth IRA, SIMPLE IRA, SEP IRA, 401(k), etc.), "Contribution Reason" will appear.

Choose "Regular" for normal contributions

Choose "Rollover - 60 Day" if you are doing a rollover and transferring in an account from an outside firm (be sure to discuss with your planner before doing so)

Click "Next" to review the deposit request, then "Confirm" to confirm.

Make a Recurring Deposit

To make a recurring deposit, log into Altruist.

Click "Transfer Funds" in the top right of the screen.

From the bump out menu, click "Deposit into Altruist".

In the "Transfer to" field, choose the account you would like to make a deposit or retirement contribution in.

In the "Transfer from" field, choose the outside account you would like to transfer in from. If the account you are looking for is not in the options, click "Add funding account".

NOTE: if you would like to transfer from an Altruist HYSA account, you will need to reach out to your planner to set up the transfer for you.

For "Frequency" choose the frequency you prefer and/or you discussed with your planner.

Then choose the start date (and end if you would like) as well as amount.

*If you are making a deposit into a retirement account (IRA, Roth IRA, SIMPLE IRA, SEP IRA, 401(k), etc.), "Contribution Reason" will appear. Choose "Regular" when depositing into an IRA since these will be normal contributions. If you are making a deposit between January and April, "Contribution year" should appear. Choose the tax year you would like the contributions to be made to (Current or Prior):

Click "Next" to review the deposit request, then "Confirm" to confirm.

Retirement Contributions

Retirement contributions are set up in the same manner as deposits into your HYSA or brokerage accounts (scroll up for instructions), but if you are making a deposit into a retirement account (IRA, Roth IRA, SIMPLE IRA, SEP IRA, 401(k), etc.), "Contribution Reason" will appear.

Choose "Regular" for normal contributions

Choose "Rollover - 60 Day" if you are doing a rollover and transferring in an account from an outside firm (*be sure to discuss with your planner before doing so)

For 401(k) accounts, you will have the option to choose "Employee" or "Employer" contribution

If you are making a contribution between January and April, "Contribution year" will also appear. Choose the tax year you would like the contributions to be made to (Current or Prior). If you are not sure, consult your planner before completing.

*If you are making backdoor Roth IRA contributions, please first discuss with your planner what contributions to make and when before setting up auto-deposits or future contributions. These contributions will go into your IRA first, but your planner needs to be made aware so they can execute the conversion and ensure you will not hit your maximum.